Introducing the Possibility: Can People Released From Personal Bankruptcy Acquire Credit Cards?

Comprehending the Influence of Personal Bankruptcy

Personal bankruptcy can have an extensive influence on one's credit rating, making it testing to access credit history or financings in the future. This financial tarnish can stick around on debt reports for numerous years, affecting the person's capability to secure positive rate of interest rates or economic opportunities.

Additionally, personal bankruptcy can limit employment possibility, as some employers conduct credit rating checks as component of the employing procedure. This can posture an obstacle to people seeking new work leads or occupation advancements. Generally, the influence of bankruptcy extends beyond monetary restraints, influencing different elements of an individual's life.

Variables Influencing Credit Report Card Approval

Complying with insolvency, people frequently have a low debt rating due to the negative influence of the bankruptcy filing. Credit scores card firms generally look for a credit rating score that demonstrates the applicant's ability to handle credit scores properly. By very carefully thinking about these variables and taking actions to restore credit rating post-bankruptcy, individuals can enhance their leads of getting a credit scores card and working in the direction of financial recovery.

Steps to Restore Credit Scores After Bankruptcy

Restoring debt after personal bankruptcy calls for a strategic technique concentrated on financial discipline and consistent financial obligation management. One effective technique is to get a guaranteed debt card, where you deposit a specific quantity as collateral to establish a credit history limit. Additionally, consider coming to be a licensed individual on a family members member's credit report card or discovering credit-builder loans to further increase your credit history rating.

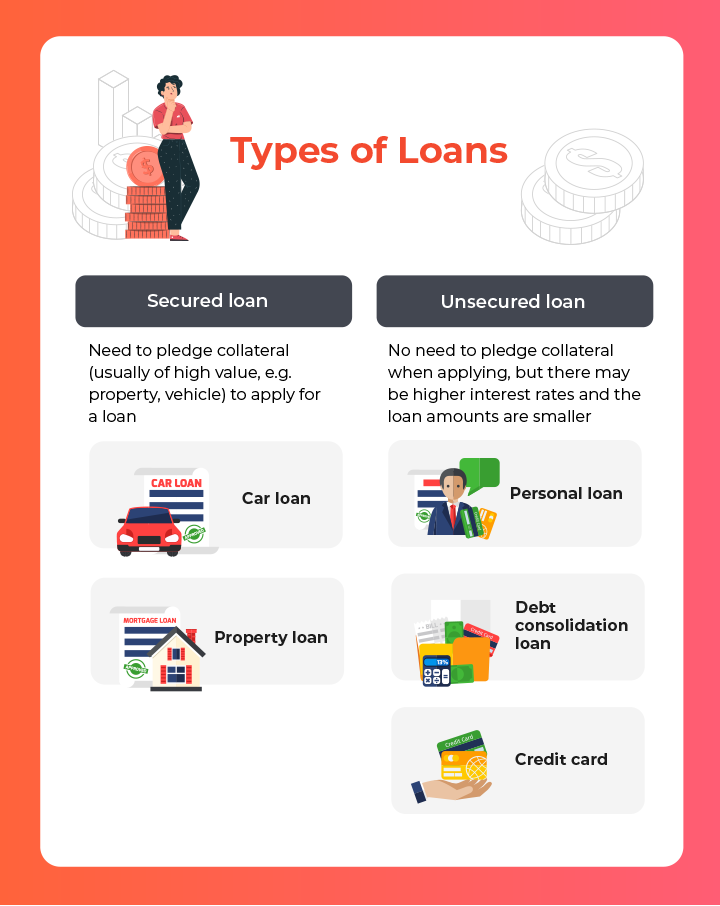

Protected Vs. Unsecured Debt Cards

Following insolvency, people frequently take into consideration the option between protected and unsafe charge card as they aim to rebuild their credit reliability and financial stability. Guaranteed charge card call for a cash money deposit that works as security, generally equivalent to the credit line provided. These cards are simpler to acquire post-bankruptcy considering that the down payment minimizes the threat for the provider. However, they may have higher fees and rates of interest contrasted to unprotected cards. On the various other hand, unprotected charge card do not require a down payment but are more difficult to receive after bankruptcy. Providers evaluate the candidate's creditworthiness and might provide reduced costs and rate of interest for those with a great financial standing. When making a decision in between both, individuals should evaluate the advantages of easier authorization with safe cards against the potential prices, and think about unprotected cards for their long-lasting monetary objectives, as they can help rebuild credit rating without binding funds in a down payment. Eventually, the option between safeguarded and unsafe bank card should align with the individual's economic goals and capacity to handle credit score properly.

Resources for People Seeking Debt Reconstructing

One useful source for people seeking credit rating restoring is debt therapy companies. By working with a credit rating therapist, people can gain insights into their credit rating reports, learn strategies to boost their credit report ratings, and get assistance on handling their financial resources successfully.

One more helpful source is credit monitoring solutions. These moved here solutions permit individuals to keep a close eye on their credit scores records, track any kind of errors or modifications, and find prospective signs of identity theft. By checking their credit regularly, individuals can proactively deal with any kind of problems that might arise and make sure that their debt information is up to day and precise.

Furthermore, online devices and sources such as credit rating simulators, budgeting apps, and monetary proficiency web sites can offer people with valuable info and tools to aid them in their credit restoring journey. secured credit card singapore. By leveraging these sources effectively, people discharged from insolvency can take purposeful actions towards boosting their credit history wellness and protecting a much better monetary future

Verdict

In verdict, people discharged from personal bankruptcy might have the chance to obtain charge card by taking steps to restore their credit rating. Elements such as debt debt-to-income, revenue, and background ratio play a substantial duty in charge card approval. By understanding my sources the impact of bankruptcy, choosing between secured and unsecured credit history cards, and making use of sources for debt restoring, individuals can boost their credit reliability and possibly get accessibility to bank card.

By working website here with a credit rating counselor, people can obtain insights into their credit scores records, find out methods to improve their credit report ratings, and receive advice on managing their funds properly. - secured credit card singapore

Comments on “Contrasting the Best Secured Credit Card Singapore Options for 2024”